NATURALSHRIMP HOLDINGS, INC.

AND SUBSIDIARIES

Consolidated Financial Statements

December 31, 2014 and 2013

NATURALSHRIMP HOLDINGS, INC. AND SUBSIDIARIES

Table of Contents

December 31, 2014 and 2013

| |

Page

|

| |

|

|

Independent Auditors’ Report

|

F-1

|

| |

|

|

Consolidated Balance Sheets

|

F-3

|

| |

|

|

Consolidated Statements of Operations

|

F-4

|

| |

|

|

Consolidated Statement of Changes in Stockholders’ Deficit

|

F-5

|

| |

|

|

Consolidated Statements of Cash Flows

|

F-6

|

| |

|

|

Notes to Consolidated Financial Statements

|

F-7

|

Independent Auditors’ Report

To the Stockholders of

NaturalShrimp Holdings, Inc.

We have audited the accompanying consolidated financial statements of NaturalShrimp Holdings, Inc. and subsidiaries (the Company), which comprise the consolidated balance sheets as of December 31, 2014 and 2013, and the related consolidated statements of operations, changes in stockholders’ deficit and cash flows for the years then ended, and the related notes to the consolidated financial statements (financial statements).

Management’s Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error.

Auditors’ Responsibility

Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits in accordance with auditing standards generally accepted in the United States of America as established by the Auditing Standards Board (United States) and in accordance with the auditing standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditors’ judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of the Company as of December 31, 2014 and 2013, and the results of its operations and cash flows for the years then ended in accordance with accounting principles generally accepted in the United States of America.

Going Concern

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note I to the financial statements, the Company has accumulated losses since inception, has negative working capital and negative equity, and is in default on certain notes, all of which raise substantial doubt about its ability to continue as a going concern. Management's plans in regard to these matters are also described in Note I. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ Turner, Stone & Company, L.L.P.

Certified Public Accountants

Dallas, Texas

April 15, 2015

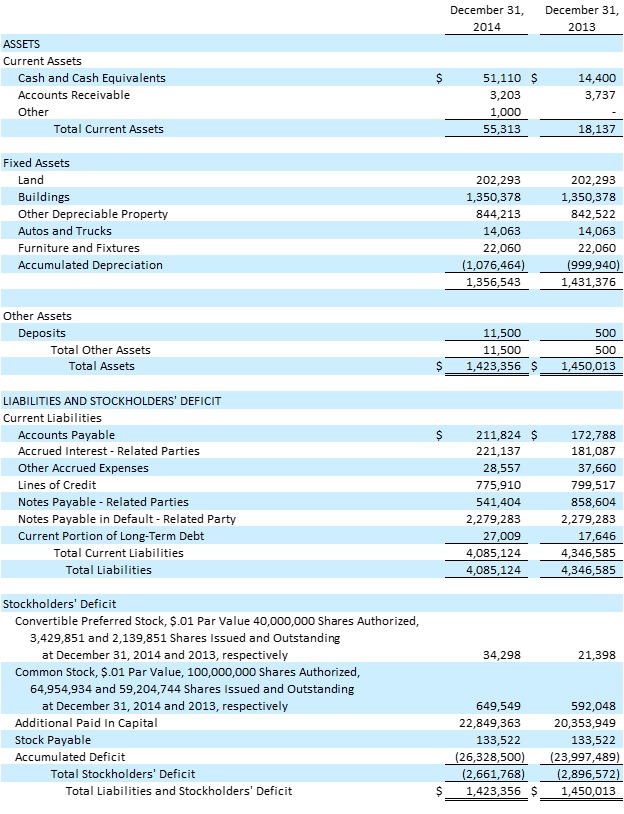

NATURALSHRIMP HOLDINGS, INC. AND SUBSIDIARIES

Consolidated Balance Sheets

December 31, 2014 and 2013

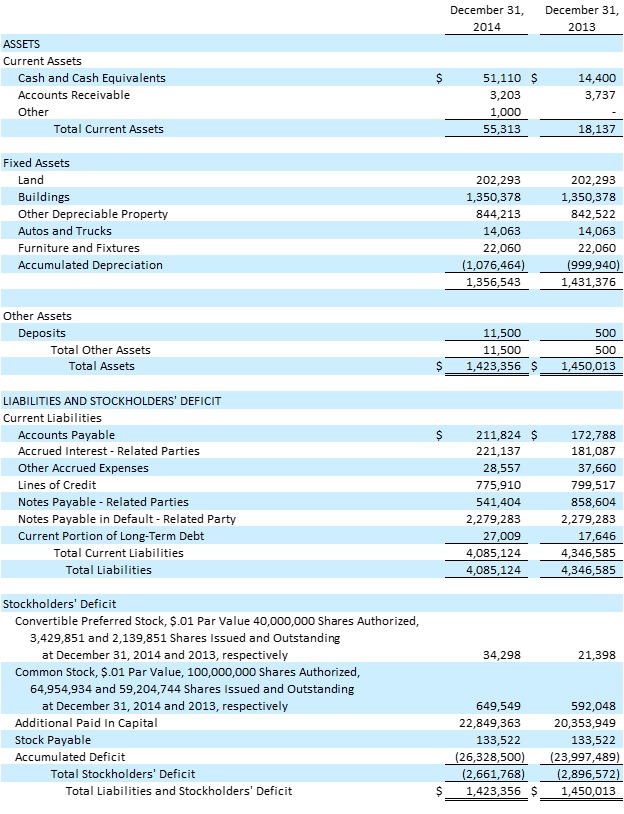

NATURALSHRIMP HOLDINGS, INC. AND SUBSIDIARIES

Consolidated Statements of Operations

For the Years Ended December 31, 2014 and 2013

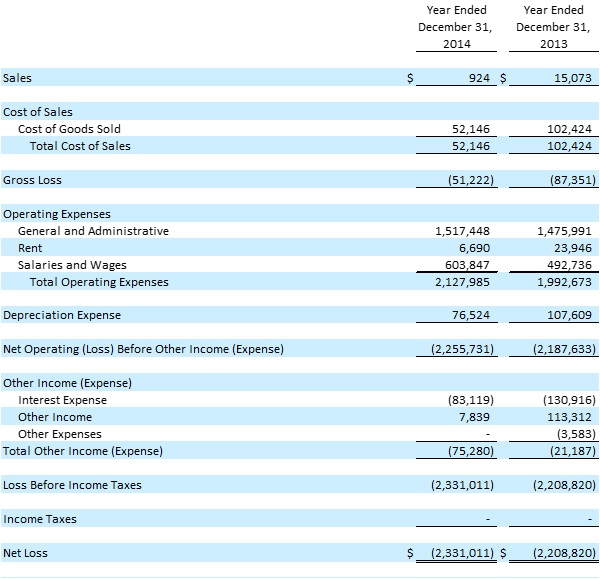

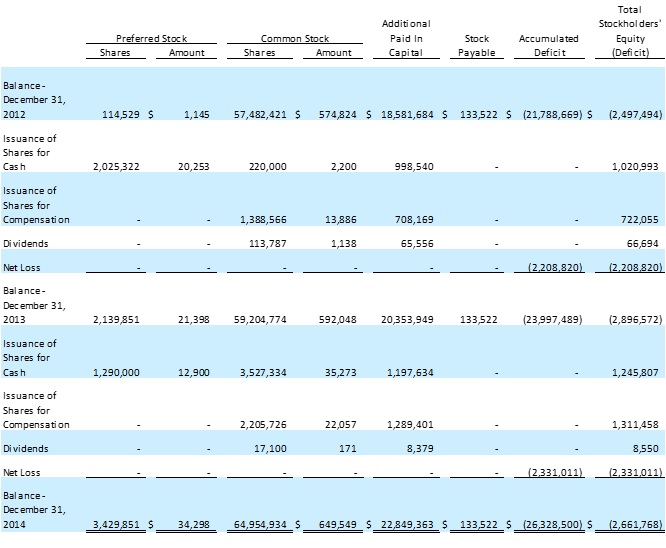

NATURALSHRIMP HOLDINGS, INC. AND SUBSIDIARIES

Consolidated Statements of Changes in Stockholders’ Deficit

For the Years Ended December 31, 2014 and 2013

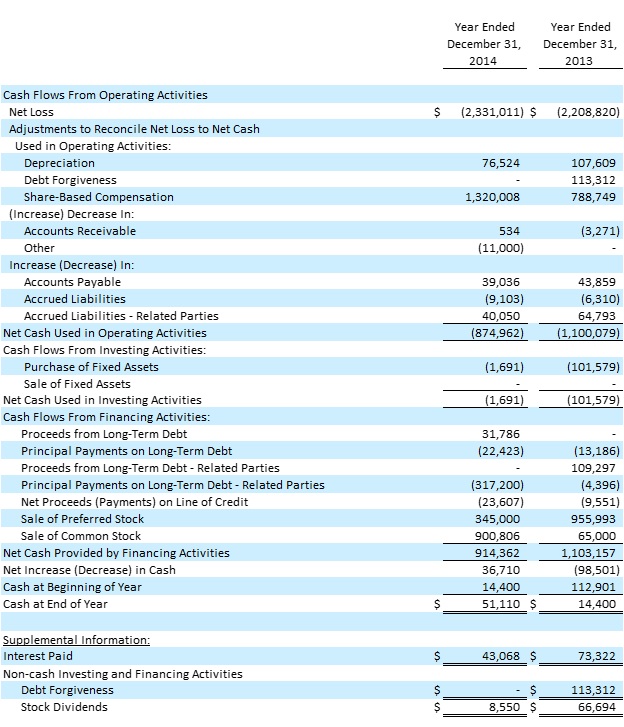

NATURALSHRIMP HOLDINGS, INC. AND SUBSIDIARIES

Consolidated Statements of Cash Flows

For the Years Ended December 31, 2014 and 2013

NATURALSHRIMP HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 31, 2014 and 2013

Note A – Nature of the Organization

On March 5, 2001, NaturalShrimp Holdings, Inc. (the Company), a successor company, was incorporated under the laws of the State of Delaware. Pursuant to the organizing documents, the Company is authorized to issue 100,000,000 shares of common stock and 40,000,000 shares of preferred stock, both classes with a par value of $0.01 per share. The Company has two wholly owned subsidiaries.

NaturalShrimp Corporation (NSC) was incorporated on August 12, 2005, under the laws of the State of Delaware and is a wholly-owned subsidiary of the Company. NSC merged with NaturalShrimp Corporation (a Texas corporation) on September 6, 2005 pursuant to an Agreement and Plan of Merger (NSC Agreement). Under the NSC Agreement, common stock changed from no par value to $0.01 par value and the number of shares authorized for issuance decreased to 1,000 shares. On March 24, 2008, NSC merged with NaturalShrimp San Antonio, L.P (NSSA) (a Texas limited partnership) pursuant to an Agreement and Plan of Merger (NSSA Agreement). NSC continued to exist as the surviving corporation. NSC is an agro-tech company that grows and sells shrimp in an indoor controlled production facility.

NaturalShrimp International, Inc. (NSI) was incorporated on August 12, 2005, under the laws of the State of Delaware and is a wholly-owned subsidiary of the Company. NSI merged with NaturalShrimp International, Inc. (a Texas Corporation incorporated November 12, 1999, as Quantum Access Corporation) pursuant to an Agreement and Plan of Merger (NSI Agreement) dated September 6, 2005. Under the NSI Agreement, common stock changed from no par value to $0.01 par value and the number of shares authorized for issuance decreased to 1,000 shares. NSI continued to exist as the surviving corporation. NSI was created for the purpose of establishing and maintaining all of the Company’s international joint ventures.

Note B – Summary of Significant Accounting Policies

Basis of Accounting

The consolidated financial statements are prepared in conformity with United States generally accepted accounting principles (GAAP).

Consolidation

The consolidated financial statements include the accounts of NaturalShrimp Holdings Inc. and its wholly owned subsidiaries, NaturalShrimp Corporation and NaturalShrimp International. All significant intercompany accounts and transactions have been eliminated in consolidation.

Equity Method of Accounting for Investments

NSI has a 50% joint venture interest in NaturalShrimp Europe Ltd. (NSE), which operates facilities in Spain. NSI’s investment in NSE is carried at cost and adjusted for NSI’s proportionate share of undistributed earnings or losses. NSE has negative equity. As a result, the amount of the investment is reported as zero on the Company’s consolidated balance sheets.

Cash and Cash Equivalents

For the purpose of the statement of cash flows, the Company considers all highly liquid instruments purchased with a maturity of three months or less to be cash equivalents. There were no cash equivalents at December 31, 2014 and 2013.

Inventories

Shrimp inventories are stated at the lower of cost (first-in, first-out method) or market. Purchased shrimp (Post Larvae or PL) are carried at purchase costs plus costs of maintenance through the balance sheet dates. Inventories were not material at December 31, 2014 and 2013.

NATURALSHRIMP HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 31, 2014 and 2013

Fixed Assets

Equipment is carried at cost and is depreciated over the estimated useful lives of the related assets. Depreciation on buildings is computed using the straight-line method, while depreciation on all other fixed assets is computed using the Modified Accelerated Cost Recovery System (MACRS) method. MACRS does not materially differ from GAAP. Estimated useful lives are as follows:

| Autos and Trucks |

5 years

|

| Buildings |

27 ½ - 39 years

|

| Other Depreciable Property |

5 - 10 years

|

| Furniture and Fixtures |

3 - 10 years

|

Maintenance and repairs are charged to expense as incurred. At the time of retirement or other disposition of equipment, the cost and accumulated depreciation will be removed from the accounts and the resulting gain or loss, if any, will be reflected in operations.

The consolidated statement of operations reflects depreciation expense of $76,524 and $107,609 for 2014 and 2013, respectively.

Revenue Recognition

Revenues for products sold are recorded upon delivery of the products to customers, which is the point at which title to the products is transferred, and when payment has either been received or collection is reasonably assured. The Company has no warranty or return policy as all sales are final. The Company extends unsecured credit to its customers for amounts invoiced.

Bad Debts

Uncollectible accounts receivable are written off at the time amounts are determined to be a loss to the Company. An allowance for doubtful accounts receivable is maintained as necessary, based upon specific accounts receivable outstanding determined to be uncollectible and the appropriate charge is made to operations. As of December 31, 2014 and 2013, no allowance for doubtful accounts was deemed necessary.

Debt Discounts

The Company amortizes discounts on debt over the life of the notes using the effective interest method.

Shipping and Handling

The Company reports shipping and handling charges to customers as part of sales and the associated expense as part of cost of sales.

Income Taxes

Deferred income tax assets and liabilities are computed for differences between the financial statement and tax basis of assets and liabilities that will result in taxable or deductible amounts in the future based on enacted tax laws and rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established when necessary to reduce deferred tax assets to the amount expected to be realized. Income tax expense is the tax payable or refundable for the period plus or minus the change during the period in deferred tax assets and liabilities.

NATURALSHRIMP HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 31, 2014 and 2013

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect certain reported amounts and disclosures. Accordingly, actual results could differ from those estimates.

Fair Value Measurements

ASC Topic 820, Fair Value Measurements and Disclosures, requires that certain financial instruments be recognized at their fair values at our balance sheets. However, other financial instruments, such as debt obligations, are not required to be recognized at their fair values, but GAAP provides an option to elect fair value accounting for these instruments. GAAP requires the disclosure of the fair values of all financial instruments, regardless of whether they are recognized at their fair values or carrying amounts in our balance sheets. For financial instruments recognized at fair value, GAAP requires the disclosure of their fair values by type of instrument, along with other information, including changes in the fair values of certain financial instruments recognized in income or other comprehensive income. For financial instruments not recognized at fair value, the disclosure of their fair values is provided below under “Financial Instruments.”

Nonfinancial assets, such as property, plant and equipment, and nonfinancial liabilities are recognized at their carrying amounts in the Company’s balance sheets. GAAP does not permit nonfinancial assets and liabilities to be remeasured at their fair values. However, GAAP requires the remeasurement of such assets and liabilities to their fair values upon the occurrence of certain events, such as the impairment of property, plant and equipment. In addition, if such an event occurs, GAAP requires the disclosure of the fair value of the asset or liability along with other information, including the gain or loss recognized in income in the period the remeasurement occurred.

At December 31, 2014 and 2013, the Company did not have any assets or liabilities that would be required to be measured under ASC Topic 820.

Financial Instruments

The Company’s financial instruments include cash and cash equivalents, receivables, payables, and debt and are accounted for under the provisions of ASC Topic 825, Financial Instruments. The carrying amount of these financial instruments, with the exception of discounted debt, as reflected in the consolidated balance sheets approximates fair value.

Stock-Based Compensation

The Company issues stock-based compensation for both contractual services of non-related and related parties. Valuation of the stock is determined by the current investing price of the stock. Once the stock is issued the appropriate expense account is charged. All stock-based compensation currently issued is 100% vested.

Recent Accounting Pronouncements

During the years ended December 31, 2014 and 2013, and through April 15, 2015, there were several new accounting pronouncements issued by the Financial Accounting Standards Board. Each of these pronouncements, as applicable, has been or will be adopted by the Company. Management does not believe the adoption of any of these accounting pronouncements has had or will have a material impact on the Company’s financial statements.

Note C – Lines of Credit

The Company has a working capital line of credit with Community National Bank. On August 28, 2013, the Company renewed the line of credit for $30,000. The line of credit bears an interest rate of 7.0% and is payable quarterly. The line of credit matured on February 28, 2014, is secured by various Company assets, and is also guaranteed by two directors of the Company. The balance of the line of credit at December 31, 2014 and 2013 was $0 and $23,200, respectively.

NATURALSHRIMP HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 31, 2014 and 2013

The Company also has a working capital line of credit with Extraco Bank. On March 12, 2014, the Company renewed the line of credit for $475,000. The line of credit bears an interest rate of 4.0% that is compounded monthly on unpaid balances and is payable monthly. The line of credit matures on March 12, 2016, and is secured by certificates of deposit and letters of credit owned by directors and shareholders of the Company. The balance of the line of credit, which includes accrued unpaid interest, was $473,029 at December 31, 2014.

The Company has additional lines of credit with Extraco Bank for $ $100,000 and $200,000, which were renewed on January 19, 2014 and March 30, 2014, respectively. The lines of credit bear an interest rate of 4.5% that is compounded monthly on unpaid balances and is payable monthly. The lines of credit matured on January 19, 2015 and March 30, 2015, respectively, and are secured by certificates of deposit and letters of credit owned by directors and shareholders of the Company. The Company is currently in negotiations with Extraco Bank to renew the lines of credit. The balance of the lines of credit was $278,470 at December 31, 2014 and 2013.

The Company also has a working capital line of credit with Capital One Bank for $50,000. The line of credit bears an interest rate of prime plus 3.89 basis points, which totaled 7.14% as of December 31, 2014 and 2013. The line of credit matures on December 12, 2015 and is unsecured. The balance of the line of credit was $10,447 and $13,423 at December 31, 2014 and 2013, respectively.

The Company also has a working capital line of credit with Chase Bank for $25,000. The line of credit bears an interest rate of prime plus 3.55 basis points, which totaled 6.80% as of December 31, 2014 and 2013. The line of credit matures on October 30, 2015, and is secured by assets of the Company. The balance of the line of credit was $13,964 and $11,395 at December 31, 2014 and 2013.

Note D – Stockholders’ Deficit

Preferred Stock

Preferred stock has a $.01 par value with 40,000,000 shares authorized. Dividends for preferred shares are calculated on a quarterly basis and shall be the greater of two (2) percent of the face value of the shares or one-half (1/2) percent of gross sales of all shrimp sold that have been produced in Company owned locations in the preceding quarter plus one-quarter (1/4) percent of the gross sales of any shrimp sold in any non fully owned shrimp producing facilities in the preceding quarter. Dividend payments can never be more than fifty (50) percent of the face value of the preferred shares in any one period. The shares can be convertible to common shares of the Company on a one for one basis at any time at the option of the holder within ten (10) years after issuance. At the end of the ten (10) year period, the preferred shares will automatically be converted into common shares of the Company.

For the years ended December 31, 2014 and 2013, activity in the number shares of preferred stock was as follows:

| |

|

Number of Shares

|

|

| |

|

|

|

|

Balance, December 31, 2012

|

|

|

114,529 |

|

|

Stock issuances

|

|

|

2,025,322 |

|

|

Balance, December 31, 2013

|

|

|

2,139,851 |

|

|

Stock issuances

|

|

|

1,290,000 |

|

|

Balance, December 31, 2014

|

|

|

3,429,851 |

|

| |

|

|

|

|

NATURALSHRIMP HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 31, 2014 and 2013

Common Stock

Common stock has a $.01 par value with 100,000,000 shares authorized.

For the years ended December 31, 2014 and 2013, activity in the number shares of common stock was as follows:

| |

|

Number of Shares

|

|

| |

|

|

|

|

Balance, December 31, 2012

|

|

|

57,482,421 |

|

|

Transactions in connection with

|

|

|

|

|

|

stock-based compensation

|

|

|

1,388,566 |

|

|

Stock Dividends

|

|

|

113,787 |

|

|

Stock issuances

|

|

|

220,000 |

|

|

Balance, December 31, 2013

|

|

|

59,204,774 |

|

|

Transactions in connection with

|

|

|

|

|

|

stock-based compensation

|

|

|

2,205,726 |

|

|

Stock Dividends

|

|

|

17,100 |

|

|

Stock issuances

|

|

|

3,527,334 |

|

|

Balance, December 31, 2014

|

|

|

64,954,934 |

|

| |

|

|

|

|

Note E – Options and Warrants

Options

The Company has not granted any options since inception.

Warrants

In accordance with the preferred shares purchase agreement, each investor received a warrant to purchase up to 50% of their original investment at a price of $0.50 per share. The warrants expire approximately three years from the agreement date.

For the years ended December 31, 2014 and 2013, activity in the warrants was as follows:

| |

|

Number of Shares

|

|

|

Weighted Average Exercise Price

|

|

| |

|

|

|

|

|

|

|

Balance, December 31, 2012

|

|

|

57,264 |

|

|

$ |

0.50 |

|

|

Warrants expired

|

|

|

- |

|

|

|

- |

|

|

Warrants cancelled

|

|

|

- |

|

|

|

- |

|

|

Warrants granted

|

|

|

1,012,661 |

|

|

|

0.50 |

|

|

Warrants exercised

|

|

|

- |

|

|

|

- |

|

|

Balance, December 31, 2013

|

|

|

1,069,925 |

|

|

|

0.50 |

|

|

Warrants expired

|

|

|

- |

|

|

|

- |

|

|

Warrants cancelled

|

|

|

- |

|

|

|

- |

|

|

Warrants granted

|

|

|

645,000 |

|

|

|

0.50 |

|

|

Warrants exercised

|

|

|

- |

|

|

|

- |

|

|

Balance, December 31, 2014

|

|

|

1,714,925 |

|

|

$ |

0.50 |

|

| |

|

|

|

|

|

|

|

|

NATURALSHRIMP HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 31, 2014 and 2013

Note F – Related Party Transactions

Notes Payable – Related Parties

Baptist Community Services (BCS)

Pursuant to an assignment agreement dated March 26, 2009, Amarillo National Bank sold and transferred a note to Baptist Community Services (BCS), a shareholder of the Company, in the amount of $2,004,820. The interest rate under the terms of the agreement is 2.25% and is payable monthly. The note is collateralized by all inventories, accounts, equipment, and all general intangibles related to the Company’s shrimp production facility in La Coste, Texas. Payment of the note is also guaranteed by High Plains Christian Ministries Foundation, a shareholder of the Company. The balance of the note at December 31, 2014 and 2013 was $2,004,820 and is classified as a current liability on the consolidated balance sheets.

Effective December 31, 2008, the Company entered into a subordinated promissory note agreement (BCS subordinated note) with BCS for $70,000 to provide working capital to pay accrued interest due under the BCS note and other operating expenses. On April 7, 2009, the BCS subordinated note was increased to $125,000 to provide additional working capital for the Company. The balance of the BCS subordinated note at December 31, 2014 and 2013 was $274,463, and is classified as a current liability on the consolidated balance sheets. During 2014 and 2013, the Company incurred $29,890 and $25,478 in interest expense on the subordinated note. At December 31, 2014 and 2013, accrued interest payable was $84,887 and $114,774, respectively..

On January 25, 2010, the Company received notice from BCS notifying it that the Company was in default of its obligations to BCS and that both the BCS note and the BCS subordinated note, as well as all accrued interest, fees and expenses, were payable in full. Pursuant to a forbearance agreement dated January 25, 2010, BCS agreed to forbear from exercising any remedies available under the notes until January 25, 2011 or the Company fails to promptly perform any of its covenants or obligation under the forbearance agreement, whichever occurs first. In 2015, a fifth forbearance agreement was executed extending the forbearance terms to December 31, 2016.

Bill G. Williams

The Company has entered into several working capital notes payable to Bill Williams, an officer, a director, and a shareholder of the Company, for a total of $486,500 since inception. These notes had stock issued in lieu of interest and have no set monthly payment or maturity date. The balance of these notes at December 31, 2014 and 2013 was $161,404 and $178,604 and is classified as a current liability on the consolidated balance sheets. Below is a detailed account of these loans as of December 31, 2014 and 2013: At December 31, 2014 and 2013, accrued interest payable was $65,084 and $30,284, respectively. The stock to be issued resulted in a debt discount of $99,960 and a stock payable for the same amount because the shares were issued with the debt. The shares were valued at a range of $0.20 to $0.60 per share, which was based on the sales unit price of the shares on the grant date. The discount was expensed to interest expense immediately because these notes are due on demand.

NSSA Partners

In 2005, the Company entered into a working capital note payable to the partners of NSSA for $500,084. Pursuant to a merger agreement dated March 19, 2008, between the Company and NSSA partners, the company converted the note into common stock at $1.00 per share. The accrued interest payable on that note was converted into a new note in the amount of $113,312. This note matured on March 19, 2013 and bore interest at 6.0% compounded annually on unpaid balances. Upon maturity in 2013, NSSA Partners forgave the loan and all outstanding accrued interest, which resulted in income and is recorded as other income on the consolidated statement of operations.

NATURALSHRIMP HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 31, 2014 and 2013

Shareholders

In 2009, the Company entered into a note payable to Randall Steele, a shareholder of the Company, for $50,000. The note bears interest at 6.0% and is payable upon maturity on January 20, 2011. In addition, the Company issued 100,000 shares of common stock for consideration. The shares were valued at the date of issuance at fair market value. The value assigned to the shares of $50,000 was recorded as increase in common stock and additional paid-in capital and was limited to the value of the note. The assignment of a value to the shares resulted in a financing fee being recorded for the same amount. The note is unsecured. The balance of the note at December 31, 2014 and 2013 was $50,000 and is classified as a current liability on the consolidated balance sheets. Interest expense on the note was $3,000 during the years ended December 31, 2014 and 2013, respectively. At December 31, 2014 and 2013, accrued interest payable was $795.

Beginning in 2009, the Company started entering into notes payable with various shareholders of the Company. The notes bear interest at 15.0% and are payable generally twelve months from the date of the note. The notes are collateralized by the shrimp crop attributable to the post larvaes (PLs) acquired from the note proceeds. Upon maturity, the holder may convert the 15.0% interest proceeds into shares at a price of $0.25 per share as defined by the agreement. Upon maturity, the holder may also convert the note principal proceeds into common stock shares at $0.25 per share. The note does not contain embedded prepayment features other than the conversion price. The shares were valued at the date of issuance at fair market value. Shares attached to these notes totaled 68,000 which resulted in a debt discount of $13,600 and a stock payable for the same amount. The discount was being amortized by the effective interest method over the life of the notes. At December 31, 2014 and 2013 the balance of these notes totaled $35,000, net of discount, and are classified as current liabilities on the consolidated balance sheets. Interest expense on these notes totaled $5,250 during the years ended December 31, 2014 and 2013. At December 31, 2014 and 2013, accrued interest payable was $23,671 and $18,421, respectively.

Beginning in 2010, the Company started entering into several working capital notes payable with various shareholders of the Company for a total of $290,000. These notes bear interest at 8% and had shares of common stock issued in lieu of interest and have no set monthly payment or maturity date. The shares were valued at the date of issuance at fair market value. The value assigned to the shares of $96,000 was recorded as increase in common stock and additional paid-in capital based on the fair market value at the grant date. The assignment of a value to the shares resulted in a debt discount being recorded for the same amount. Because the debt has no specific repayment terms and are due on demand, the Company expensed the entire debt discount. The balance of these notes at December 31, 2014 and 2013 was $295,000 and $595,000 and is classified as a current liability on the consolidated balance sheets. At December 31, 2014 and 2013, accrued interest payable was $62,500 and $41,700, respectively.

Note G – Federal Income Tax

The Company accounts for income taxes under FASB ASC 740-10, which provides for an asset and liability approach of accounting for income taxes. Under this approach, deferred tax assets and liabilities are recognized based on anticipated future tax consequences, using currently enacted tax laws, attributed to temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts calculated for income tax purposes.

For the years ended December 31, 2014 and 2013, the Company incurred net operating losses and, accordingly, no provision for income taxes has been recorded. In addition, no benefit for income taxes has been recorded due to the uncertainty of the realization of any deferred tax assets. The Company has not filed Federal income tax returns since the year ended December 31, 2010. Therefore, there is no readily available estimate of net operating losses.

NATURALSHRIMP HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 31, 2014 and 2013

Based on the available objective evidence, including the Company’s history of losses, management believes it is more likely than not that any net deferred tax assets will not be fully realizable. Accordingly, the Company provided for a full valuation allowance against its net deferred tax assets at December 31, 2014 and 2013, respectively.

In accordance with FASB ASC 740, the Company has evaluated its tax positions and determined there are no uncertain tax positions.

Note H – Concentration of Credit Risk

The Company maintains cash balances at one financial institution. Accounts at this institution are insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000. As of December 31, 2014 and 2013, the Company’s cash balance did not exceed FDIC coverage.

Note I – Going Concern

The Company has accumulated losses since inception, has negative working capital and negative equity, and is in default on certain notes. These factors raise substantial doubt about the Company’s ability to continue as a going concern.

Management plans to address the going concern issues by raising additional capital for growth and plant expansion. The Company plans to improve the growth rate of the shrimp and the environmental conditions of its production facilities. Management also plans to acquire a hatchery in which the Company can better control the environment in which to develop the post larvaes. If management is unsuccessful in these efforts, discontinuance of operations is possible. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty. See Note J.

Note J – Subsequent Events

On January 30, 2015, the Company consummated the sale of substantially all of its assets (“Assets”) to Multiplayer Online Dragon, Inc. (“Multiplayer”), a publicly-held Nevada corporation, pursuant to an Asset Purchase Agreement (“Agreement”) dated November 26, 2014 by and between the Company and Multiplayer. In accordance with the terms of the Agreement, the Company received approximately 75,500,000 shares of Multiplayer as consideration for the Assets, which consist primarily of certain real property located near San Antonio, Texas. As a result of the sale, the Company now owns approximately 89% of Multiplayer’s issued and outstanding shares of common stock.